Keeping track of your business transactions

Typically a business should have a Cash account in their general ledger that tracks all of the transactions within a business. These transactions include income from customers, payments made for business expenses, and the like. Similarly, when a business opens a business checking account with a bank, the bank will record all of these transactions on a bank statement. At the end of each month, the bank will close out this list of transactions and mail a statement to the business. This will show every detail for all of the activity for that account, as well as a total balance.

Reconciling the bank statement

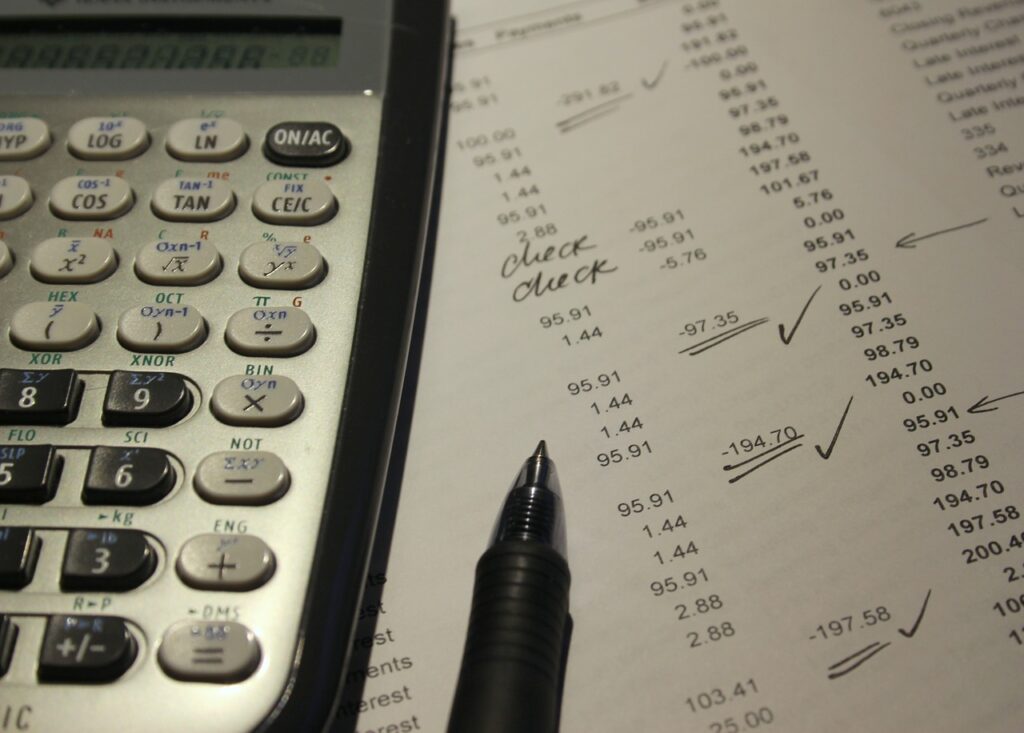

Once the business has received its bank statement, the person in charge of the bookkeeping should examine the information and compare it to the records kept in the Cash account of the general ledger. This will help to confirm all of the information is correct, and to detect any potential problems. This process is known as “reconciling the bank statement”.

Discrepencies between bank statements and your ledger

Taking the time to reconcile a bank statement is necessary in order to make sure the information the bank is consistent with the company records. Since many businesses have a large number of transactions each month, the process of reconciling the bank statement can take a bit of time. This can also be a somewhat complicated issue, because there may be items that appear in the company’s ledger that have not yet appeared on the bank statement.

For example, if a check was written off of the business checking account at the end of the month, it may not clear the bank until the following month. Another example could be if the bank decreases the balance of the business’s account without first notifying the business. This could be related to a service fee, for a bounced check, or any other type of miscellaneous fee. Even a small difference such as this could cause a discrepancy between the business ledger and the bank statement.

Another possible explanation for a discrepancy could be because neither the ledger nor the balance reflected on the bank statement is correct. Both records may need to be adjusted in order to reflect true balances.

Once you have looked over all of the numbers and found where the differences occur, you should find that you are able to adjust the balance or balances, and that all of the numbers now match; your bank statement will then be properly reconciled.

Books Onsite

Are you in need of a Bookkeeper? Get in touch with us on 1300 2BOOKS. Alternatively you can fill in our online contact form and one of our friendly staff will be in contact you.